The holiday season, while filled with joy and celebration, can also bring a significant amount of stress and anxiety for many. As the largest medical cannabis clinic in Northeast Florida, we understand the importance of finding effective ways to manage this seasonal pressure. In this comprehensive guide, we’ll explore how cannabis can be a valuable tool in your stress-management toolkit, helping you navigate the holidays with greater ease and enjoyment.

Understanding Holiday Stress

The festive season, despite its cheerful reputation, can be a challenging time for many. From financial pressures to social obligations, the holidays often bring a unique set of stressors that can impact our mental and physical well-being.

Common Holiday Stressors

- Financial strain from gift-giving and entertaining

- Pressure to meet social expectations and family obligations

- Time management challenges balancing work and personal commitments

- Travel-related stress and disruptions

- Increased social interactions, which can be overwhelming for some

- Seasonal Affective Disorder (SAD) due to shorter, darker days

The Impact of Holiday Stress

Prolonged stress during the holiday season can lead to various health issues, including:

- Sleep disturbances

- Changes in appetite and eating habits

- Increased anxiety and depression symptoms

- Physical symptoms like headaches and muscle tension

- Weakened immune system, making you more susceptible to illness

Understanding these stressors is the first step in developing effective coping strategies. For many, incorporating cannabis into their wellness routine can provide significant relief and help restore balance during this hectic time of year.

The Science Behind Cannabis and Stress Relief

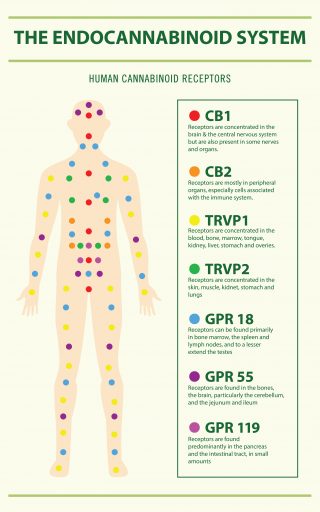

To appreciate how cannabis can help manage holiday stress, it’s essential to understand the science behind its stress-relieving properties. The key lies in the interaction between cannabis compounds and our body’s endocannabinoid system (ECS).

The Endocannabinoid System and Stress Regulation

The ECS plays a crucial role in maintaining balance within our bodies, including regulating stress responses. It consists of cannabinoid receptors (CB1 and CB2) spread throughout the body, endocannabinoids produced naturally by our bodies, and enzymes that break down these compounds.

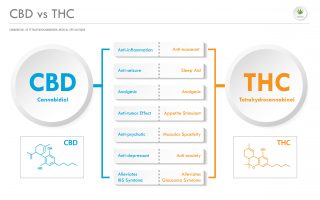

When we experience stress, the ECS works to bring our body back to a state of equilibrium. Cannabis compounds, particularly THC and CBD, can interact with this system, potentially enhancing its stress-regulating effects.

How Cannabis Compounds Affect Stress

- THC (Tetrahydrocannabinol): This psychoactive compound binds directly to CB1 receptors in the brain, potentially reducing anxiety and promoting relaxation. However, it’s important to note that high doses of THC can sometimes increase anxiety in some individuals.

- CBD (Cannabidiol): Unlike THC, CBD doesn’t bind directly to cannabinoid receptors. Instead, it works indirectly to modulate the ECS and other neurotransmitter systems. CBD has shown promise in reducing anxiety and stress without the psychoactive effects associated with THC.

- Terpenes: These aromatic compounds found in cannabis can also contribute to stress relief. For example, linalool (also found in lavender) and myrcene have calming properties.

Understanding this scientific basis helps explain why many people find cannabis effective for managing stress, including the heightened stress often experienced during the holiday season.

Cannabis Strains for Holiday Stress Relief

When it comes to using cannabis for holiday stress management, choosing the right strain can make a significant difference. Different strains have varying ratios of cannabinoids and terpenes, leading to diverse effects. Here are some strains that may be particularly helpful for holiday stress:

- Northern Lights: Known for its deeply relaxing effects

- Granddaddy Purple: Offers full-body relaxation and mood elevation

- Blue Dream: Provides a balance of relaxation and mild euphoria

- Octane Mint Sorbet: Known for its deeply relaxing effects

- Fruitopia: Provides a balance of relaxation and mild euphoria

- Ice Cream Cake: Provides a balance of relaxation and euphoria

- Miracle Fruit: Provides an uplifting euphoria, boosts mood

Remember, individual responses to cannabis can vary, and it’s always best to start with a low dose, especially if you’re new to using cannabis for stress relief.

Consumption Methods for Holiday Stress Management

The way you consume cannabis can significantly impact its effects on stress relief. Here are some popular methods and their potential benefits for managing holiday stress:

Inhalation Methods:

Immediate onset (1-5 minutes)

- Vaporizing:

- Quick onset of effects (within minutes)

- Easier to control dosage

- Less harsh on the lungs compared to smoking

- Smoking:

- Rapid relief from stress symptoms

- Wide variety of strains available

- Social aspect for some users

- Dabbing:

-

- Rapid relief from stress symptoms

- Wide variety of strains available

- High potency – less is needed for a stronger effect

Oral and Sublingual Methods:

Long-lasting effects (4-6 hours or more)

- Tinctures:

- Fast-acting when taken sublingually

- Easy to measure precise doses

- Capsules:

-

- Easy to measure precise doses

- More discreet and convenient than tincture

- Edibles:

-

- Wide variety of options (gummies, chocolates, baked goods)

- No inhalation required

Topical Methods

- Creams and Lotions:

- Localized relief for stress-related muscle tension

- Non-psychoactive, even when THC is present

- Easy to incorporate into a self-care routine

Try: 1:1 lotion or lavender bergamot body butter from Sunburn or The Fix 1:1 balm from Surterra

2. Transdermal Patches:

-

- Steady, long-lasting effects

- Discreet and easy to use

- Bypass digestive system, potentially reducing side effects

Patches from Surterra or MUV. Surterra has them in all of their Wellness lines and MUV’s patches last for us to 72 hours!

Each method has its pros and cons, and the best choice depends on individual preferences, desired onset time, and duration of effects. Experimenting with different methods can help you find the most effective approach for managing your holiday stress.

Microdosing Cannabis for Stress Management

Microdosing is a technique that involves taking very small amounts of cannabis to achieve therapeutic benefits without experiencing significant psychoactive effects. This approach can be particularly useful for managing holiday stress, especially for those who need to remain functional and clear-headed throughout the day.

Benefits of Microdosing for Holiday Stress

- Subtle stress relief without impairment

- Improved mood and focus

- Reduced anxiety without sedation

- Easier to maintain daily routines and responsibilities

How to Microdose Cannabis

- Start with a very low dose (e.g., 2.5mg THC or 5mg CBD)

Try: 2.5mg mints from Surterra, 2.5 lozenges from Curaleaf. Or 2.5 lozenges from Sunburn

- Wait at least an hour to assess effects before considering another dose

- Gradually increase dosage if needed, but maintain minimal psychoactive effects

- Keep a journal to track dosages and effects

Best Products for Microdosing

- Low-dose edibles (1-5mg per serving)

- Tinctures with precise droppers

- Vape pens (micro draws throughout the day)

- Low-THC, high-CBD strains for smoking or vaporizing

Microdosing can be an effective way to incorporate cannabis into your stress management routine during the busy holiday season, allowing you to experience the benefits of cannabis while maintaining your daily responsibilities.

Combining Cannabis with Other Stress-Relief Techniques

While cannabis can be an effective tool for managing holiday stress, combining it with other stress-relief techniques can enhance its benefits and provide a more comprehensive approach to well-being during the festive season.

Mindfulness and Meditation

Incorporating mindfulness practices with cannabis use can deepen relaxation and stress relief:

- Use cannabis before a meditation session to enhance focus and presence

- Practice mindful consumption by paying attention to the effects and sensations

- Combine CBD with yoga for a calming, centered practice

Exercise and Physical Activity

Cannabis can complement your exercise routine for stress relief:

- Use a sativa strain before light exercise for increased energy and motivation

- Apply a THC or CBD-infused topical after workouts to soothe sore muscles

- Try a balanced hybrid strain for outdoor activities like hiking or gardening

Aromatherapy and Essential Oils

Combining cannabis with aromatherapy can create a multi-sensory relaxation experience:

- Use lavender oil alongside CBD for enhanced calming effects

- Try peppermint or lemon oil with a focus-enhancing cannabis strain for mental clarity

- Pair citrus scents like orange and grapefruit and uplifting sativa strains for mood elevation

Healthy Sleep Habits

Cannabis can support better sleep, which is crucial for stress management:

- Create a calming bedtime routine that includes low-dose cannabis

- Try incorporating CBN into your medication routine orally with gummies or tincture

- Try an indica capsule or tincture before vaping or smoking to ensure you stay asleep longer

Try: CBN vapes and gummies from Sunburn, CBN capsules or gummies from Trulieve

Potential Risks and Considerations

While cannabis can be an effective tool for managing holiday stress, it’s important to be aware of potential risks and considerations, especially during the festive season.

Interactions with Alcohol and Other Substances

- Avoid mixing cannabis with alcohol, as it can intensify effects and impairment

- Be cautious with caffeine, as some strains may increase anxiety when combined with caffeine or other stimulants

- Consult with a healthcare provider about potential interactions with medications

Driving and Operating Machinery

- Never drive or operate heavy machinery under the influence of cannabis

- Be aware that impairment can last several hours after consumption, especially if consumed orally or sublingually

- Plan alternative transportation for holiday events if using cannabis

Social and Family Considerations

- Be mindful of the legal status of cannabis in your area and when traveling

- Consider the preferences and comfort levels of family members and hosts

- Have a plan for discreet consumption if needed in social situations

Overconsumption and Tolerance

- Start with low doses, especially when trying new products or strains

- Be aware that edibles can have delayed and prolonged effects

- Take breaks to prevent building tolerance and maintain effectiveness

Mental Health Considerations

- Be cautious if you have a history of anxiety or panic disorders

- Avoid high-THC strains if prone to paranoia or anxiety

- Consult with a mental health professional if using cannabis for stress management

By being aware of these considerations, you can use cannabis more safely and effectively as part of your holiday stress management strategy.

Legal and Travel Considerations

When using cannabis for holiday stress management, it’s crucial to be aware of legal issues, especially if you’re traveling during the festive season.

Understanding Local Laws

- Research cannabis laws in your destination if traveling

- Be aware that cannabis remains illegal under federal law in the United States

- Understand the differences between medical and recreational cannabis regulations

Traveling with Cannabis

- Never cross state or international borders with cannabis products

- If flying, leave all cannabis products at home to avoid legal issues

- Research alternatives at your destination if you rely on cannabis for stress management

Medical Cannabis Reciprocity

- Some states honor out-of-state medical cannabis cards

- Check reciprocity laws before traveling with your medical cannabis card

- Be prepared to provide proper documentation if using reciprocity

Alternative Options While Traveling

- Research CBD options, which may be more widely available

- Consider non-cannabis stress management techniques for your trip

- Consult with a healthcare provider about temporary alternatives

By staying informed about legal considerations, you can avoid potential issues and ensure a stress-free holiday experience while managing your well-being with cannabis.

Incorporating Cannabis into Holiday Traditions

For those who find cannabis helpful in managing holiday stress, there are creative ways to incorporate it into festive traditions, creating new and enjoyable experiences.

Cannabis-Infused Holiday Recipes

- Infused hot cocoa for cozy winter evenings

- Cannabis butter for baking holiday cookies and other treats

- THC or CBD-infused gravy or stuffing for a relaxing holiday meal

Relaxation Rituals

- Create a pre-family gathering meditation routine with CBD

- Use a calming strain before holiday decorating to enhance creativity

- Incorporate a low-dose edible into your holiday self-care routine

Social Activities

- Host a cannabis-friendly holiday movie night (where legal)

- Organize a “strain tasting” event for adult friends and family

- Create cannabis-themed holiday crafts or decorations

Remember to always prioritize safety, legality, and the comfort of all participants when incorporating cannabis into holiday activities.

As we’ve explored throughout this guide, cannabis can be a valuable tool in managing holiday stress when used responsibly and in conjunction with other wellness practices. From understanding the science behind its stress-relieving properties to choosing the right strains and consumption methods, there are numerous ways to incorporate cannabis into your holiday stress management strategy.

Remember, the key to effectively using cannabis for stress relief lies in finding the right balance that works for you. Start with low doses, be mindful of legal considerations, and always prioritize your overall well-being. By taking a holistic approach that combines cannabis with other stress-relief techniques, you can create a more relaxed, enjoyable holiday season.

As the largest medical cannabis clinic in Northeast Florida, we are here to support your journey towards a less stressful holiday season. If you have questions about using cannabis for stress management or are interested in obtaining a medical cannabis card, don’t hesitate to reach out to our knowledgeable team. You can always give us a call or shoot us a text at 904-586-0041.

Here’s to a peaceful, joyous, and stress-free holiday season!